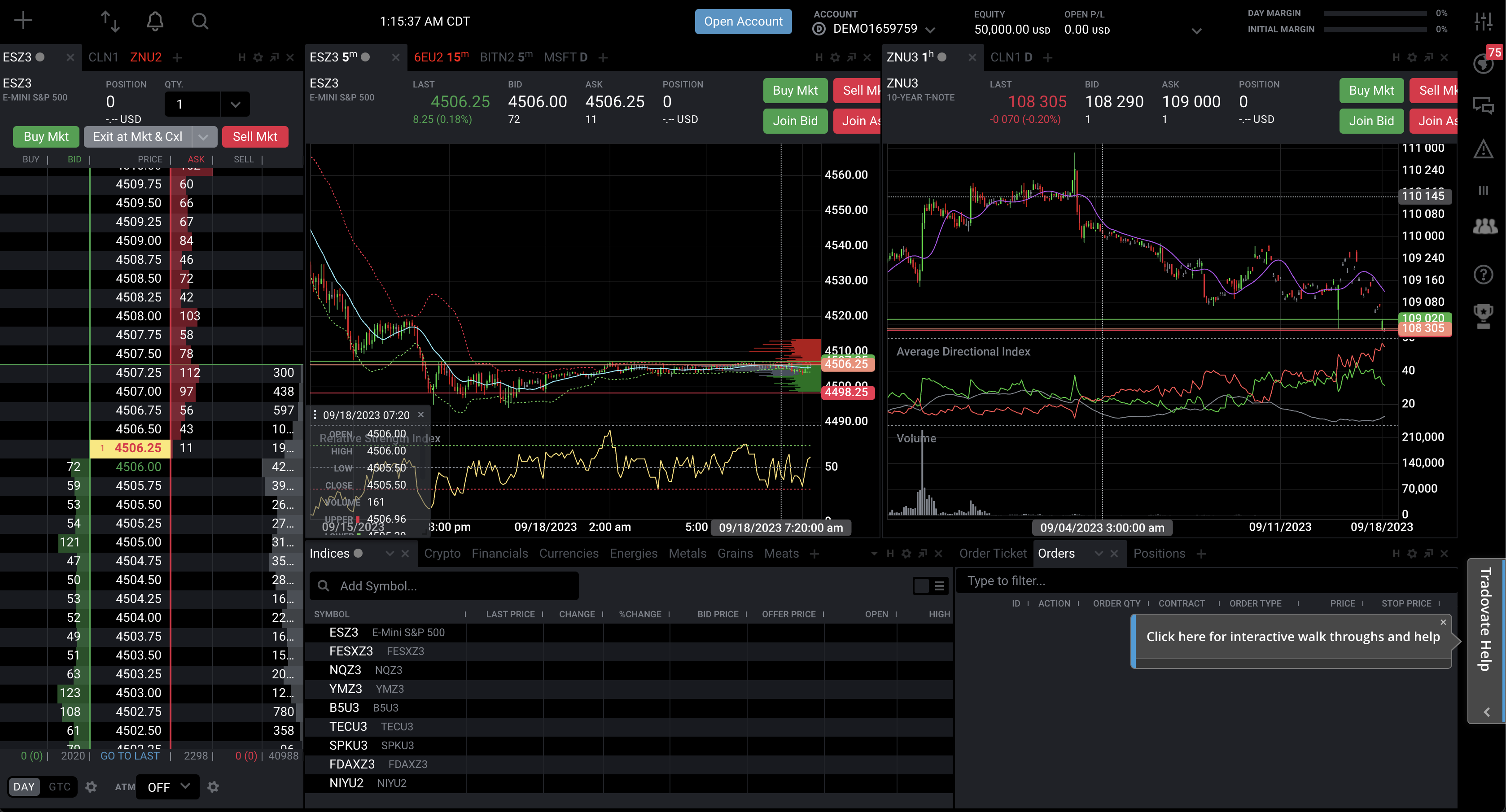

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all of more than the initial investment. How can i tell how much margin my positions require? Is margin trading in futures different from stock trading? What is the margin on 50+ micro or 25+ emini index contracts?

My original plan was to go with amp, but they recently increased their after. Feb 1, 2017 · here is an overview of the different margin types applicable to futures trading: Day margin is the minimum requirement to day trade a contract, which means opening. Tradovate is an nfa registered futures commission merchant (nfa id# 0309379) that accepts orders and receives customer funds to support such orders to traders of futures exchange. You can access the reports through the account drop. We offer the micro. I was looking at the day and initial margin requirements. I only day trade es. I never hold over night. Do i need to have the $12k initial margin to day trade or the $500 is the.

The Alana Cho Leak: The Legal Ramifications

The Livvy Dunne Phenomenon: The Leak And Its Aftermath

Ghetto Tube: The Biggest Surprise In Internet History