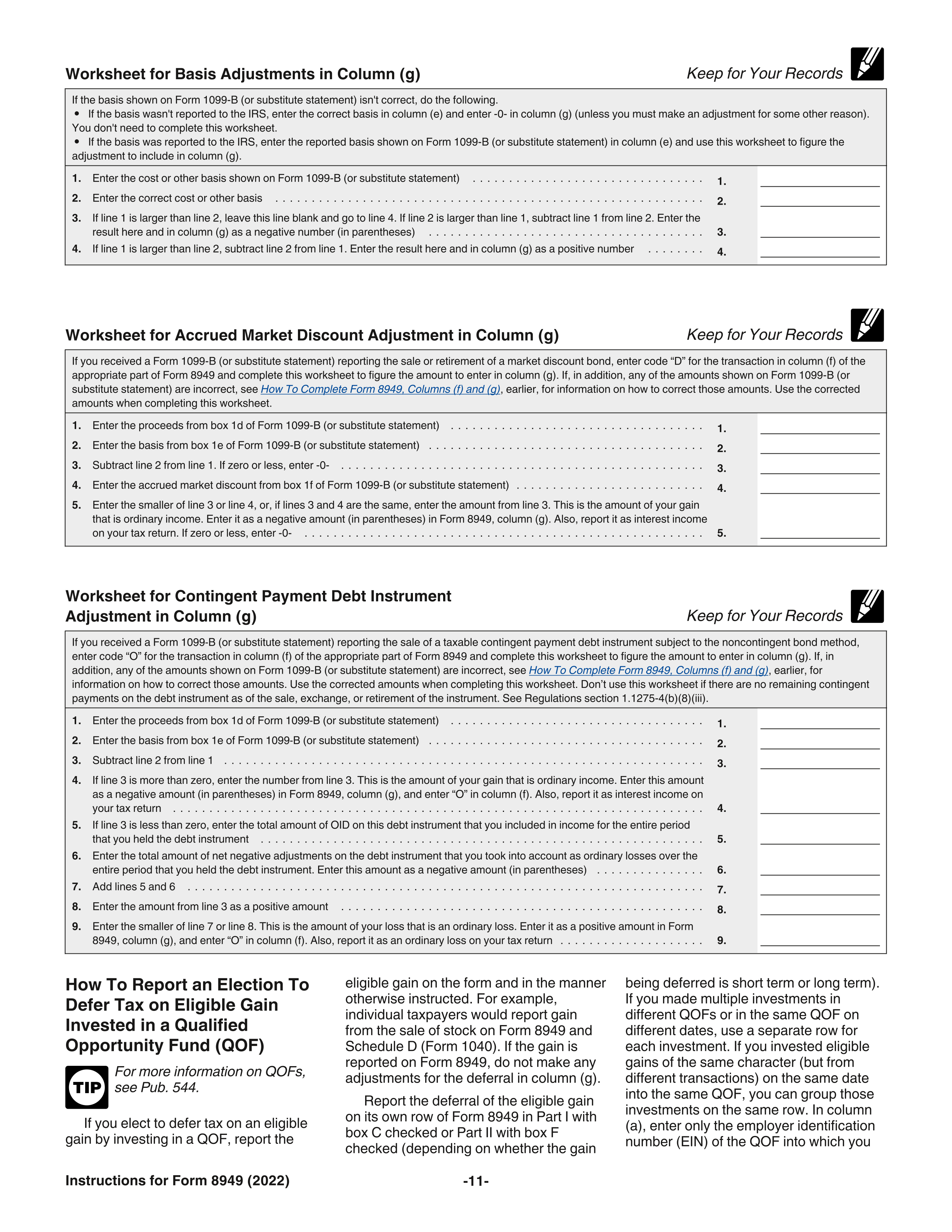

Information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Form 8949 is used to list all capital gain. Feb 23, 2024 · form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. Use form 8949 to report sales and exchanges of capital assets. Form 8949 is used to report the sale or exchange of capital assets, such as stocks, real estate, or cryptocurrencies to the irs.

I Can't Believe This Happened To SophiaRaiins OnlyFans

The Salice Rose OnlyFans Leak: A Comprehensive Report

Unmasking Alinity's OnlyFans: The Truth Revealed