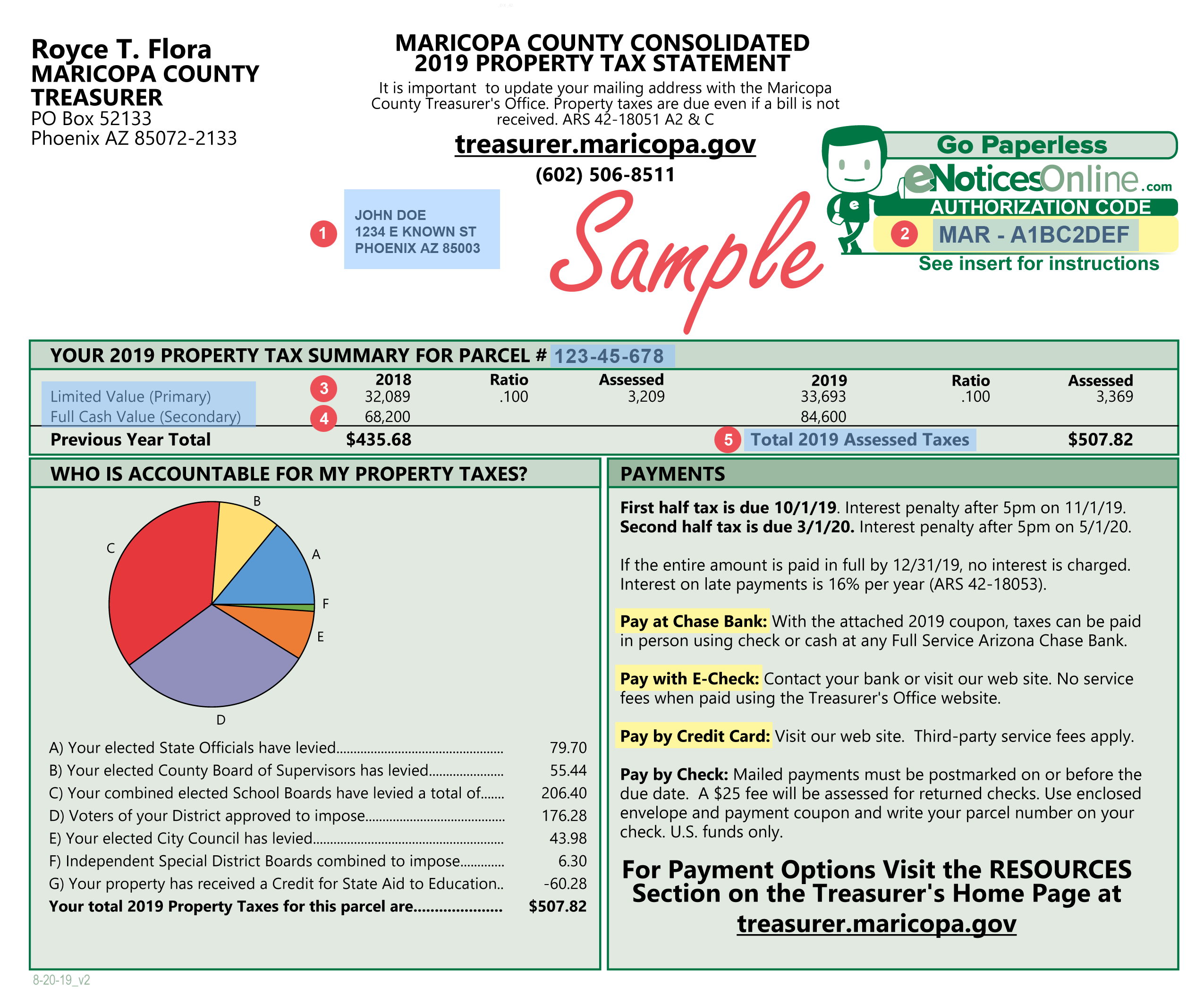

The maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school districts, special taxing districts and the. Access quick links to maricopa county property tax bill information and learn about tax calculations, payments, and credits. Online payments made through the treasurer’s website help ensure payments are posted both accurately and timely. Cancellations for online payments can only be done on the same day the payment was made. Prefer paying your taxes once a year?

You can type in your name, business name, situs address, parcel/account number, or vehicle identification number (vin) to find the information you are looking for. For information on how to pay your property taxes, please click here. I didn't receive my tax bill, what do i do? If you have not received your tax bill please contact the treasurer's office at 602. Form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or rented by the taxpayer. 301 west jefferson street phoenix, arizona 85003 main line:

The Karely Ruiz Leak: A Moment In Time

Lovenexy Exposed: The Bombshell That Shatters Everything

What's This Object In The Sky? EXSUMMERS Leak Explains