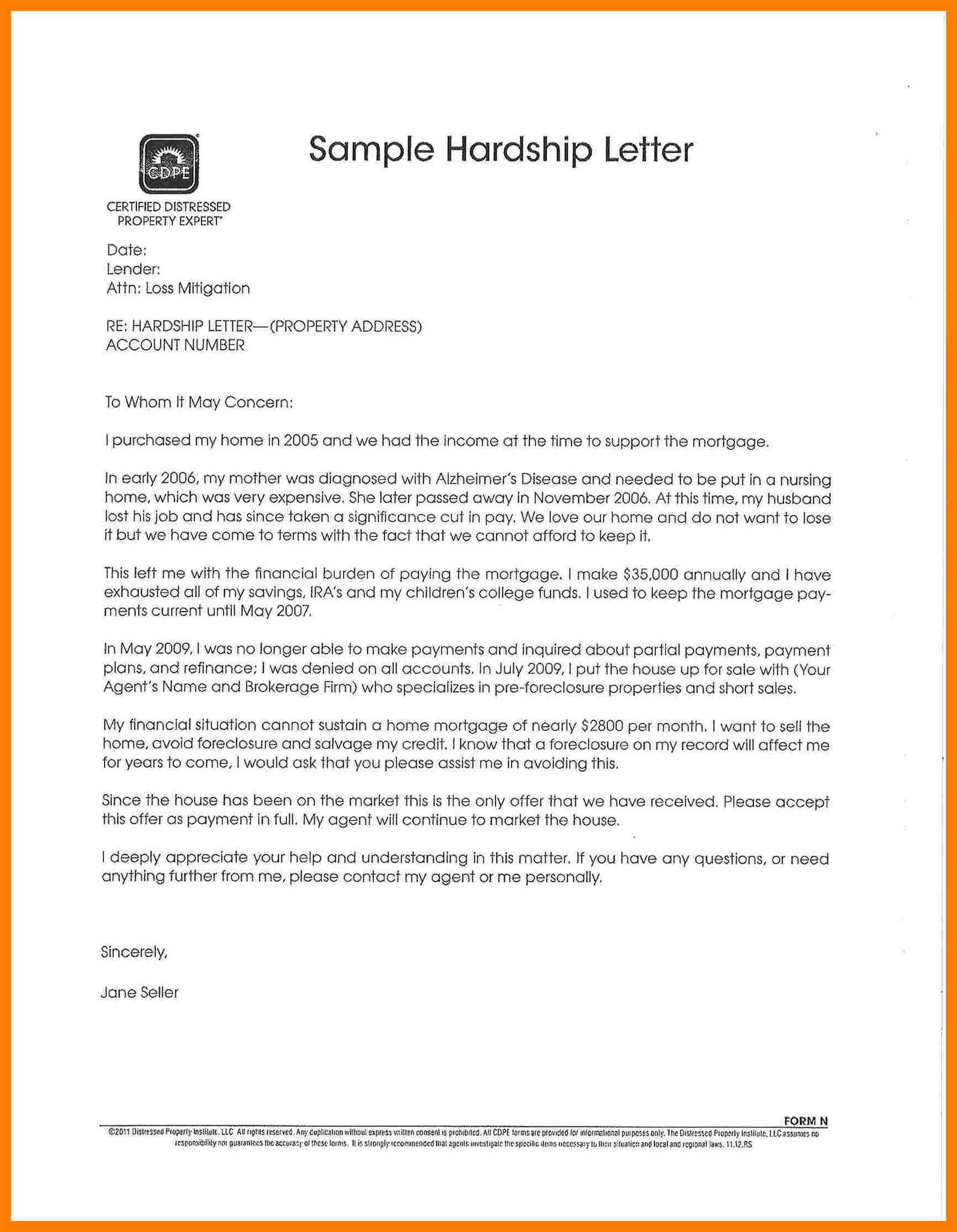

Has anyone had issues with a company denying your 401k hardship withdrawal? I’m broke and need to access some funds in a 401k i have. I requested a hardship withdrawal stating my late. Nov 4, 2022 · in some situations, you may withdraw from your 401 (k) due to hardship, but you must pay a 10% penalty on that withdrawal. You can use a hardship withdrawal for costs.

Any distribution you take, even a hardship, is still subject to both ordinary income tax and a 10% early distribution penalty. Better to not raid your 401k at all, look for. Some retirement plans, such as 401 (k) and 403 (b) plans, may allow participants to withdraw from their retirement accounts because of a financial hardship, but these withdrawals must. Many 401 (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. For example, some 401 (k) plans may allow a.

The Raerockhold Leaks: What We Learned

Pamibaby's Journey: Finding Peace After The Storm

The Peach Jar Leak Everyone Is Hiding